How US News Events Could Impact EURUSD Price Action

The EUR/USD currency pair, often referred to as the “Fiber”, is one of the most traded pairs in the forex market, reflecting the strength of the Euro against the US Dollar. Today, market participants are focused on a series of high-impact USD news events, including speeches from US President Donald Trump and multiple Federal Reserve officials, which could provide crucial insights into US monetary policy and economic outlook. In addition, unemployment claims data and the Philadelphia Fed Business Outlook Survey will gauge the health of the US economy. From the European side, Germany’s Producer Price Index (PPI) and consumer confidence data from the Eurozone will influence Euro sentiment. A stronger-than-expected US economic outlook or a hawkish stance from FOMC members could drive the USD higher, putting pressure on EURUSD. Conversely, any signs of economic weakness or dovish tones may lead to USD weakness, supporting the Euro.

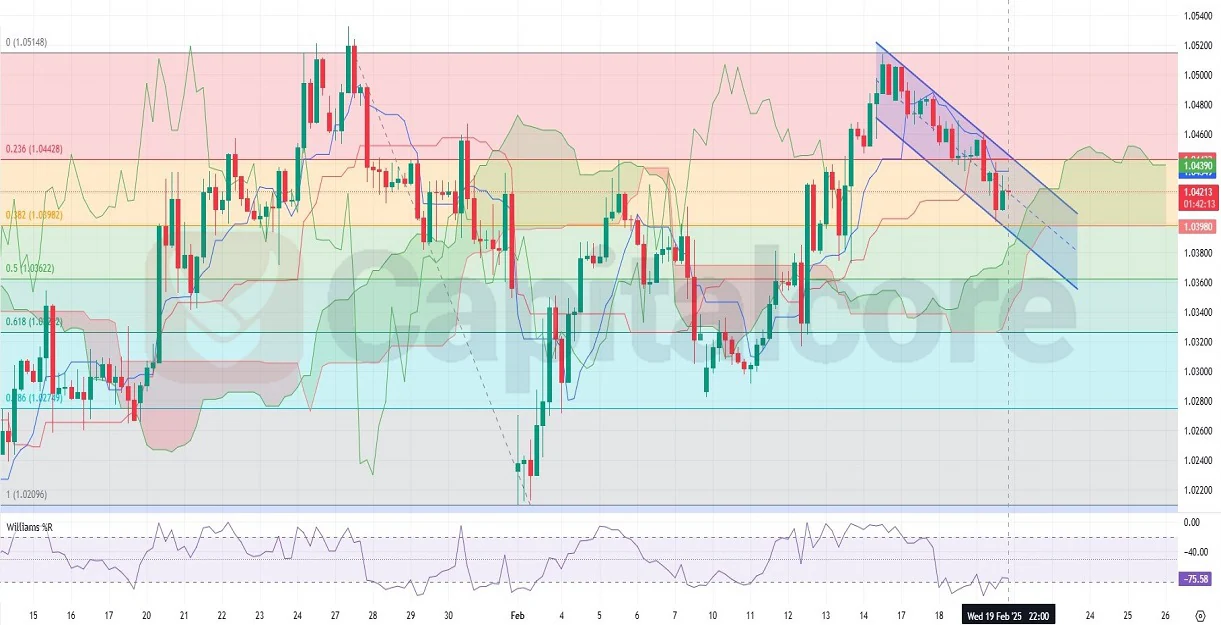

Chart Notes:

• Chart time-zone is UTC (+02:00)

• Candles’ time-frame is 4h.

The EUR/USD H4 chart is currently showing a bearish trend within a descending channel, despite the fact that the price is still above the Ichimoku cloud. However, it is approaching the 0.382 Fibonacci retracement level, which aligns with the upper band of the Ichimoku cloud, forming a critical support zone. If this level holds, a potential bounce-back could occur, but a breakdown would signal further downside potential. The Ichimoku cloud remains green, suggesting a longer-term bullish sentiment, though it has become thinner, indicating weakening support. Meanwhile, the Williams %R indicator is in oversold territory, which could hint at a short-term retracement or consolidation before further downward movement. Traders should closely watch how the EUR USD price reacts at these levels, as breaking below the cloud could accelerate selling pressure, while a strong bounce may signal a reversal.

• DISCLAIMER: Please note that the above analysis is not an investment suggestion by “Capitalcore LLC”. This post has been published only for educational purposes.