GBPUSD H4 Technical Analysis and Price Action Forecast

The GBP vs USD currency pair, often referred to as “Cable,” is one of the most actively traded forex pairs globally, representing the exchange rate between the British pound (GBP) and the US dollar (USD). It is influenced by economic indicators from both the UK and the US, as well as central bank policies and geopolitical events. Today, fundamental factors are playing a crucial role in shaping the pair’s direction, with key UK economic reports such as Retail Sales, Public Sector Net Borrowing, and PMI data set to be released. A higher-than-expected retail sales figure could boost GBP strength, while weaker numbers might lead to a bearish move. Additionally, US economic events, including a speech by Federal Reserve Governor Adriana Kugler and key PMI data, could provide further volatility. If the Fed signals a more hawkish stance, USD could gain strength, pressuring GBPUSD downward. Chart Notes:

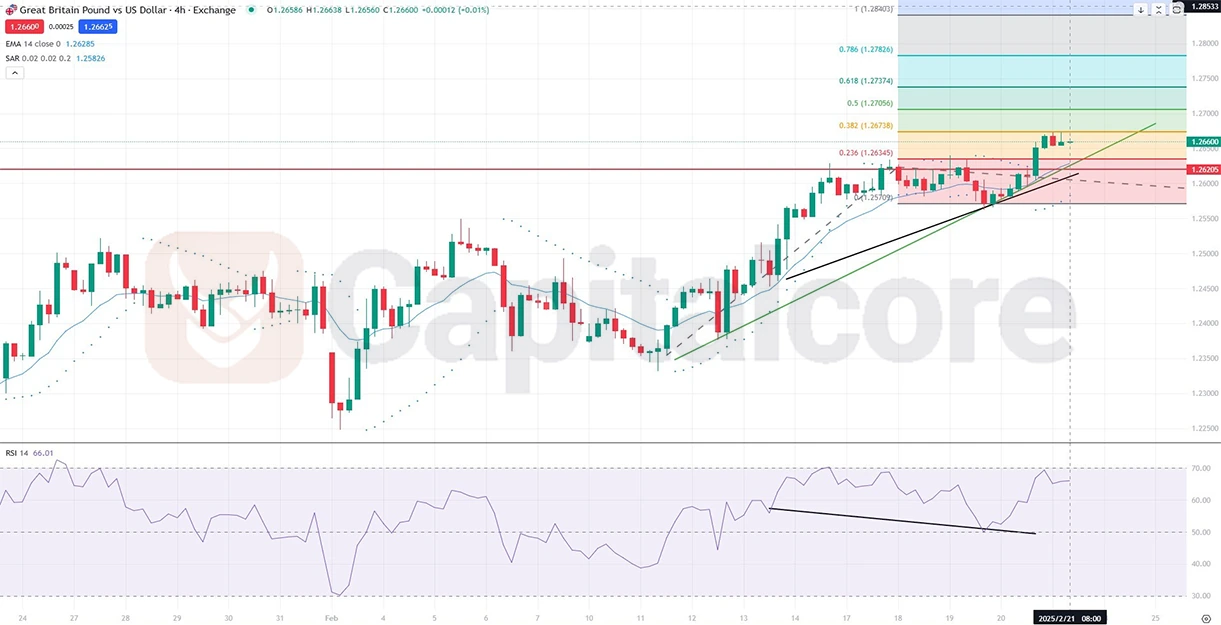

Chart Notes:

• Chart time-zone is UTC (+02:00)

• Candles’ time-frame is 4h.

On the GBP-USD H4 chart, after breaking the 1.26205 resistance level, the price seems to be pulling back towards this broken level, aligning with a potential correction. The formation of a pin bar candle at the top supports the likelihood of a short-term decline before resuming the uptrend. The key support levels to watch are around 1.26205 and the ascending trendline, with Fibonacci retracement levels 0.382 (1.26738), 0.5 (1.27056), and 0.618 (1.27374) serving as potential upside targets once the correction is complete. Additionally, RSI divergence is signaling a possible short-term reversal as price action creates higher highs while RSI prints lower highs, indicating weakening bullish momentum. The RSI level at 66.01 suggests that the pair is approaching overbought conditions, reinforcing the correction scenario before further upward continuation.

•DISCLAIMER: Please note that the above analysis is not an investment suggestion by “Capitalcore LLC”. This post has been published only for educational purposes.