Euro Strength Challenges Exporters

The EURUSD forex pair, representing the exchange rate between the euro and US dollar, remains closely watched as traders assess recent economic developments and central bank signals. Currently trading near key resistance at 1.1420, EURUSD has gained roughly 10% since March due to rising fiscal spending in Germany and heightened global trade tensions, posing headwinds for Eurozone exporters. Conversely, the US dollar recently saw its worst monthly decline in two years, pressured by fears of stagflation and ongoing tariff concerns. Upcoming US economic data, alongside ECB monetary policy adjustments, will be critical in shaping near-term direction for EURUSD.

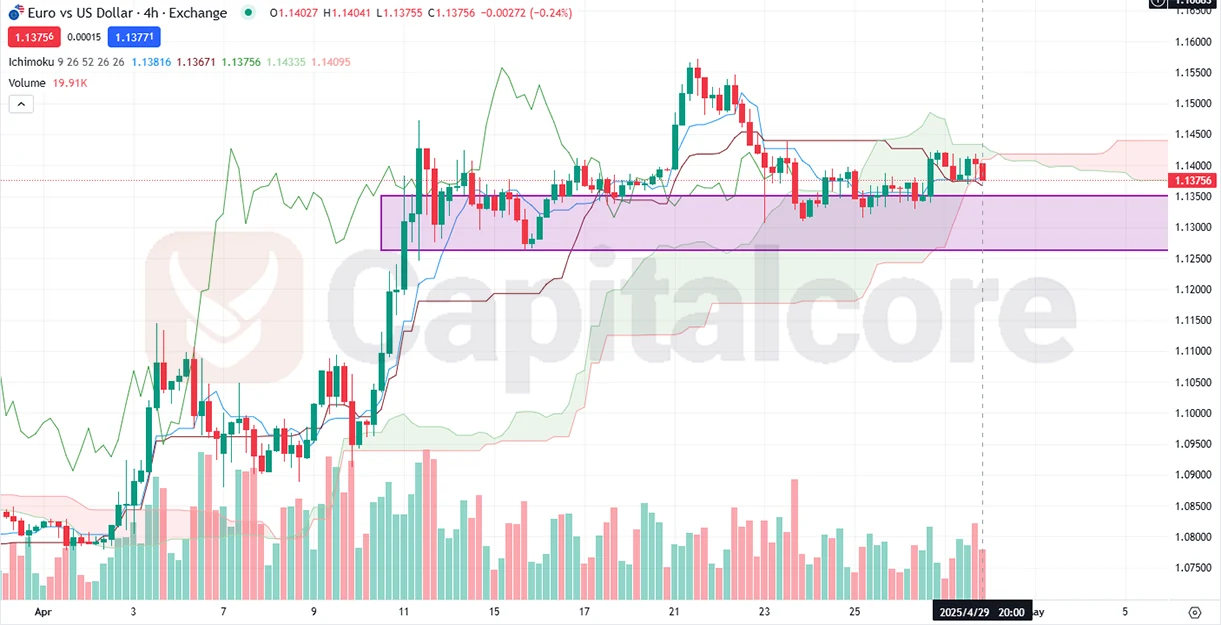

Chart Notes:

• Chart time-zone is UTC (+03:00)

• Candles’ time-frame is 4h.

On the EURUSD H4 chart technical analysis, the price has entered an extended period of consolidation, fluctuating within a significant support zone between approximately 1.13100 and 1.13000, clearly indicated by the Ichimoku cloud’s lower boundary. Despite currently trading above the cloud—traditionally interpreted as bullish—the flatness of both the Span A and Span B lines within the cloud suggests weakening bullish momentum and reflects market indecision. The recent price action has struggled to establish clear directional momentum, repeatedly encountering resistance at intermediate levels. Additionally, trading volume has notably decreased throughout this sideways movement, underscoring diminishing market conviction and hinting at potential exhaustion among bullish traders. Given these indicators, there is an increasing probability that bearish pressure may strengthen, particularly if the price fails to sustain its current support. Traders should remain cautious and closely observe volume shifts alongside clear rejection or breakout patterns near the established support at around 1.13000 and the critical resistance zones at approximately 1.15000 and 1.15800 to determine the forthcoming directional bias.

• DISCLAIMER: Please note that the above analysis is not an investment suggestion by “Capitalcore LLC”. This post has been published only for educational purposes.