USDCHF H4 Fundamental and Price Action Insights

The USDCHF currency pair, often nicknamed the “Swissie,” represents the US Dollar against the Swiss Franc and is a popular pair among forex traders due to its stability and safe-haven characteristics. In today’s market outlook, the focus is on USDCHF fundamental and technical setups, integrating core elements from the EURCHF daily chart technical and fundamental analysis to gain deeper price action insights. From a fundamental perspective, today’s economic calendar is packed with high-impact events, notably the US Core Durable Goods Orders and Durable Goods Orders, both of which are expected to show weakness compared to previous readings, possibly increasing downside pressure on the US Dollar. Furthermore, speeches from FOMC members Kashkari and Musalem could inject volatility, especially if they hint at future rate policy changes. On the Swiss side, traders will keep an eye on the SNB Quarterly Bulletin and UBS Economic Expectations, which may boost the Franc if the tone remains cautious or dovish. In the context of EURCHF analysis, increased safe-haven demand for CHF may spill over into USDCHF, further supporting a bearish outlook.

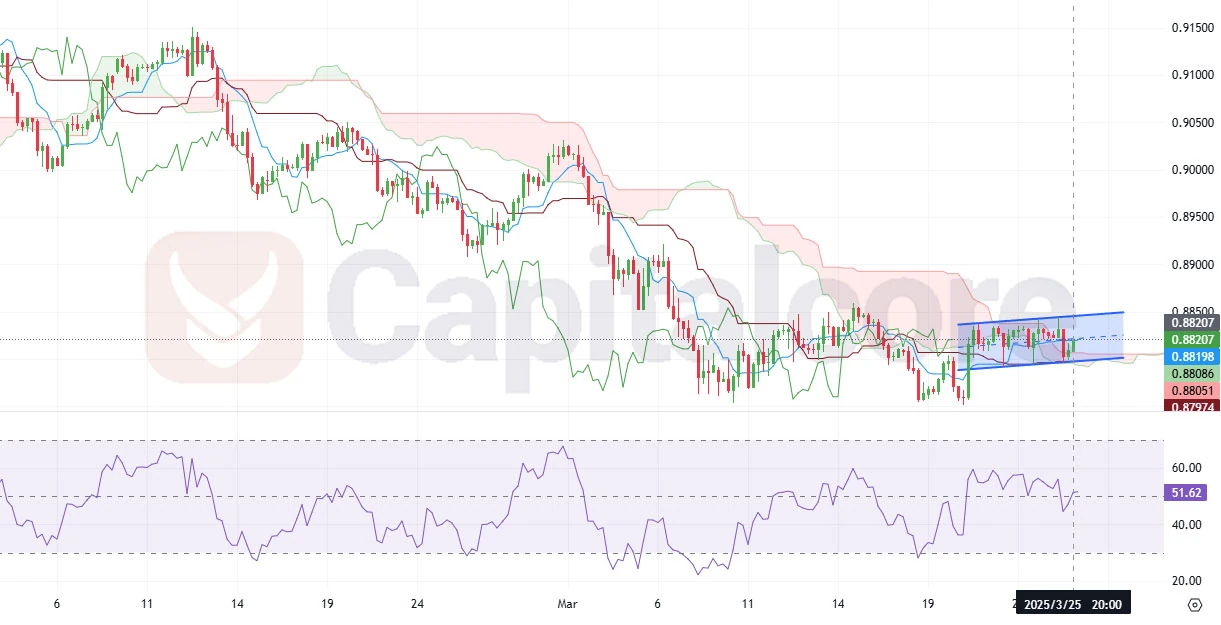

Chart Notes:

Chart Notes:

• Chart time-zone is UTC (+02:00)

• Candles’ time-frame is 4h.

Technically analyzing the USDCHF H4 chart, the pair has been riding a bearish wave and currently trades below the Ichimoku cloud, signaling a dominant downtrend. The price action is now approaching the cloud once again, indicating a potential retest phase which could either lead to a rejection or a reversal. The RSI indicator reveals bearish divergence, suggesting momentum is weakening despite minor upward moves, strengthening the bearish case. This setup presents sellers with a promising opportunity to consider short positions, particularly if price gets rejected from the lower edge of the cloud. This aligns well with overall bearish sentiment observed in EURCHF daily chart technical and fundamental analysis, enhancing the probability of further downside in USDCHF price action.

• DISCLAIMER: Please note that the above analysis is not an investment suggestion by “Capitalcore LLC”. This post has been published only for educational purposes.