Potential Impact of Economic Data on EURUSD

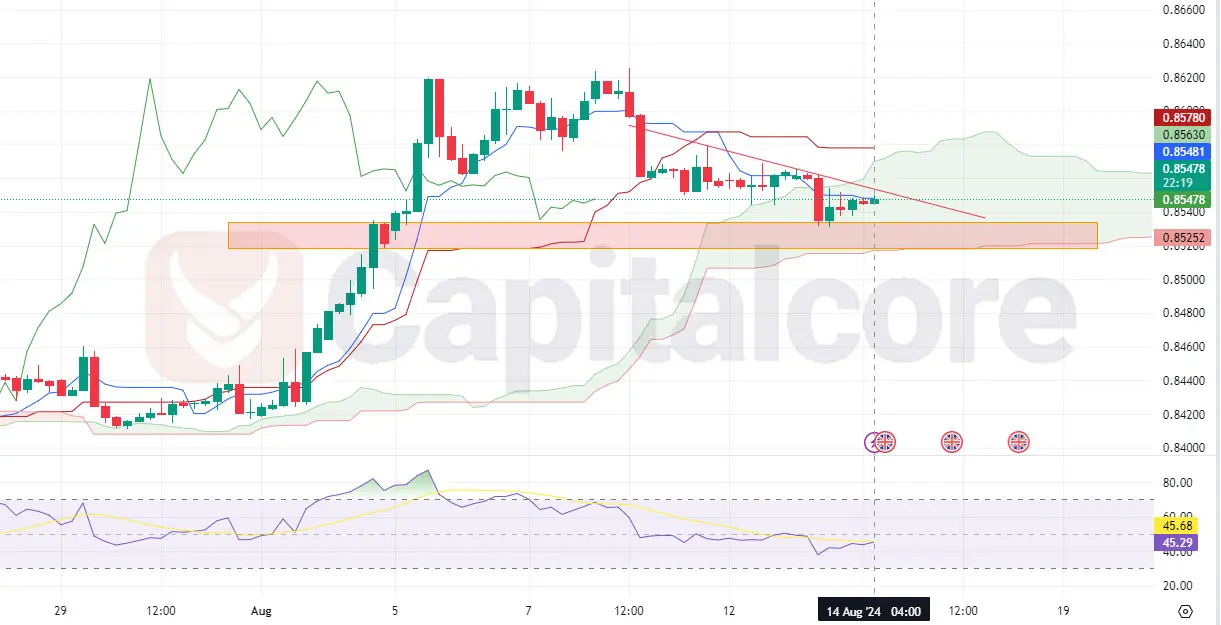

The EUR/GBP currency pair, often referred to as the “Chunnel,” represents the exchange rate between the Euro and the British Pound, two of Europe’s most significant currencies. Today this pair is closely watched by traders due to the economic interdependence and geographic proximity of the Eurozone and the United Kingdom. In the H4 chart above, EUR/GBP is observed at a critical stage, encountering a strong resistance level that aligns with the Ichimoku cloud. This situation marks an important point for potential price movements following a significant bullish rally succeeded by a corrective phase. The green hue of the cloud indicates lingering bullish sentiments, suggesting the possibility of continuing the upward trend, pending a decisive breach of the resistance.

Chart Notes:

• Chart time-zone is UTC (+03:00)

• Candles’ time-frame is 4h.

Upon closer examination of the price action on EURGBP chart, we can see that this pair has been consolidating within a descending triangle pattern, characterized by a clear resistance around the 1.0950 level and solid support at 1.0900. This pattern typically signals accumulation in technical analysis, where the price action tightens as the market prepares for a potential breakout. The recent behavior of the EUR/USD suggests that traders are possibly gearing up for a move higher, supported by increasing bullish momentum. The MACD indicator further underscores this perspective, with a bullish divergence emerging as the MACD line ascends toward the signal line, indicating growing strength in buying activity. Moreover, the RSI remains robust, positioned above 50 and trending higher, which highlights the persistence of bullish sentiment among traders. This combination of technical signals—particularly the bullish MACD divergence and the strong RSI—strongly points toward a forthcoming bullish breakout. Traders should monitor the 1.0950 resistance level closely; a convincing break above this could open the path to higher resistance levels, affirming the ongoing bullish trend in the EUR/USD market.

DISCLAIMER: Please note that the above analysis is not an investment suggestion by “Capitalcore LLC”. This post has been published only for educational purposes.: Please note that the above analysis is not an investment suggestion by “Capitalcore LLC”. This post has been published only for educational purposes.