- December 30, 2024

- Posted By: james w

- Category: Market News

Williams %R and Fib Levels Shape EUR/USD Outlook

The EURUSD forex pair, often referred to as “Fiber,” is one of the most traded currency pairs in the forex market, representing the euro against the US dollar. As a barometer for global economic sentiment, it is heavily influenced by macroeconomic indicators and monetary policy decisions from both the European Central Bank (ECB) and the Federal Reserve (Fed).

Today, the market awaits critical economic data that could impact EUR/USD’s direction. From the Eurozone, the Consumer Price Index (CPI) data will provide key insights into inflation trends, which could signal potential future policy actions from the ECB. Higher-than-forecast CPI results could strengthen the euro by increasing the likelihood of tighter monetary policy. On the US side, the Chicago PMI and Pending Home Sales reports are set to shed light on business activity and consumer demand. If these reports outperform expectations, they could reinforce the dollar’s strength, given its role as a leading indicator of economic health. Traders should prepare for heightened volatility as the interplay between these releases unfolds.

Chart Notes:

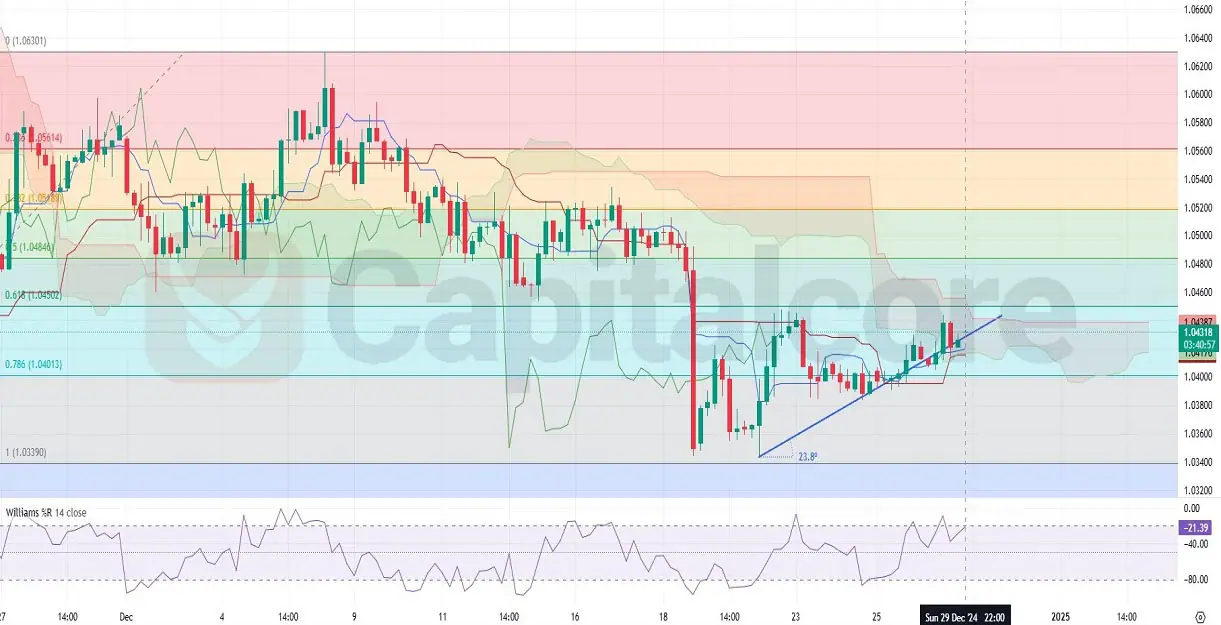

• Chart time-zone is UTC (+02:00)

• Candles’ time-frame is 4h.

The EURUSD H4 chart displays a bullish price action, as the pair has successfully broken above the lower cloud line of the Ichimoku Kinko Hyo indicator, indicating potential upward momentum. The last two candlesticks are positive, reflecting buyer confidence as the price moves away from the 0.786 Fibonacci retracement level toward the 0.618 level. This upward trajectory is further supported by the Williams %R indicator, which stands at -21.39, nearing overbought territory. This suggests that while the bullish trend is strong, traders should remain cautious of potential resistance at the cloud’s upper boundary or near the 0.618 Fibonacci level. The Fiber appears poised to challenge higher levels if the momentum persists, with upcoming economic news likely playing a decisive role.

• DISCLAIMER: Please note that the above analysis is not an investment suggestion by “Capitalcore LLC”. This post has been published only for educational purposes.