- Posted By: james w

- Category: Market News

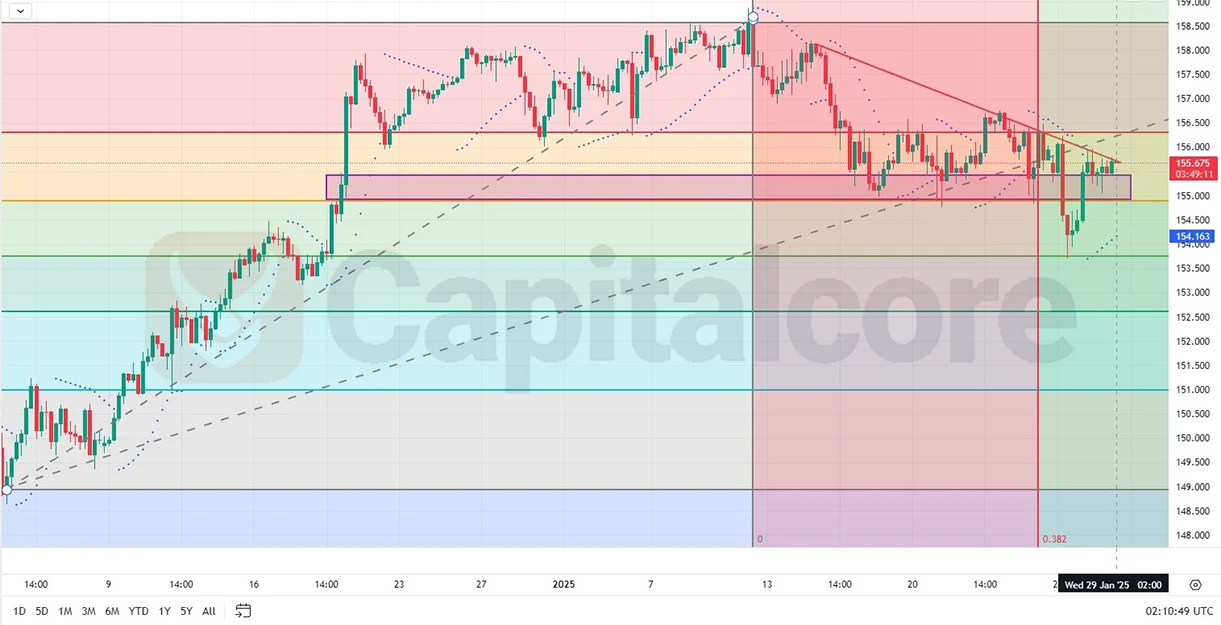

USD/JPY Market Analysis Fundamental and Technical Overview

The USDJPY currency pair, often referred to as the “Ninja,” represents the exchange rate between the U.S. dollar (USD) and the Japanese yen (JPY). This pair is one of the most traded in the forex market, heavily influenced by macroeconomic factors, central bank policies, and global risk sentiment. Fundamentally, today’s focus is on key economic releases from the U.S. and Japan that could impact USD/JPY’s price action. The U.S. GDP Advance release is the most significant data point, with a higher-than-expected reading likely to boost the USD due to positive economic growth signals. Additionally, U.S. jobless claims will provide insights into labor market conditions, where a lower-than-forecasted number could strengthen the dollar. Japan’s Tokyo CPI data and industrial production figures are also crucial, as higher inflation could pressure the Bank of Japan towards tighter monetary policies, supporting the yen. However, if U.S. data surprises on the upside, USD JPY may continue its bullish momentum. Moreover, upcoming data on pending home sales and natural gas inventories could add volatility, influencing market sentiment and risk appetite.

Chart Notes:

• Chart time-zone is UTC (+02:00)

• Candles’ time-frame is 4h.

The USDJPY H4 chart shows price movement between a strong support zone and a descending resistance line. The price has tested the resistance multiple times, indicating a potential breakout, especially with the appearance of a bullish engulfing candle. The last seven Parabolic SAR dots are positioned below the price, reinforcing bullish momentum. Fibonacci retracement analysis shows that after reacting to the 0.5 level, the price is heading back toward the resistance. The trend-based Fibonacci tool also highlights a critical turning point ahead, which may determine whether the recent downtrend continues or reverses. If price breaks above the descending resistance, a strong bullish rally could follow, while failure to do so might result in another retest of the support zone.

• DISCLAIMER: Please note that the above analysis is not an investment suggestion by “Capitalcore LLC”. This post has been published only for educational purposes.